Based on many of these files, when your lender is sure your panels is safe in order to lend currency getting, the loan might be approved.

It needs to be detailed that expenses you have got for the interior spaces of one’s strengthening try omitted on the mortgage.

Verification Techniques To have Household Structure Mortgage

Technical Verification: The fresh new credibility off requisite are verified because of the cross-guaranteeing the house. It should be detailed you to up to one hundred% cost of the financing, the home try belonging to the bank and can be put right up getting market in the eventuality of multiple non-payments from inside the cost.

Courtroom Confirmation: A nominated attorneys about financial usually now charge a fee the brand new courtroom records of the house. Your complete most of the data files with it towards building and also the bank helps them to stay once checking before the full financing repayment. This is accomplished whether your strengthening/property is arranged to have auction from the lender

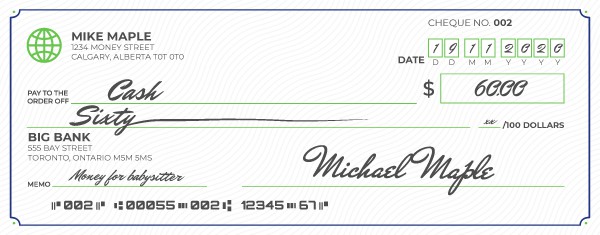

Home Design Mortgage Disbursement: The loan costs initiate once all conformity is accomplished and the house or property is actually completely affirmed. The new money are performed when it comes to cheques, signed because of the businesses manager.

Unlike the commission sorts of mortgage brokers to own in a position for fingers services, Construction loans are paid in bits, also known as Pulls.

Brings are set times where the financial institution loans the building. The number of periods in addition to amount at each and every of those is chatted about and you may decided by the latest builder, visitors, in addition to lender/financial.

Particularly, say the total amount is decided to-be ten % at each period. So, you can acquire the original ten% of one’s financing if the mortgage was closed, another will come in the event that situation comes plus the foundation is placed. Followed closely by next mark whenever glory and you will roofing system is decided and the like. Usually, the initial draw is composed of the new down-payment.

However, for additional brings the bank will demand some evidence of the new structure improvements at each and every period to pay for the project then, by which its you’ll need for the consumer to add him or her that have photo on the build and you will permits on the contractor regarding new stage out-of end.

More over, you need to generate faith together with your bank on the enterprise financial support with proofs, about lack of which, the lending company can also post a tuned specialist to evaluate the progress by themselves.

Leading loan providers including SBI, HDFC Ltd, ICICI Lender, etcetera., was active in the design financing portion. Although not, Bangalore locals trust Bajaj Funds Minimal to possess an increase make sure business to have financing for the flats, property and you can under structure strategies while they pursue RBI repaired interest rate.

An educated build loan lenders providing in the city off Bangalore are : Future Funds (Chandigarh), Sree Financial (Malleswaram, Bangalore), KMB Lovers LLP (Shankarapuram, Bangalore), Sutapa click this over here now Dutta (Mumbai), Pleased Lifetime Economic Services (BTM Design, Bangalore)

Margin Currency

Like other funds, to guarantee the applicant’s capital and you can interest in the project the guy must lead towards the structure. This share is known as ount away from mortgage.

It includes new plot’s rates if this is purchased prior to. However, the cost will not be provided if the area is a forever or try a gift.

House Framework Mortgage Limitation

Based on any is gloomier, you can either get financing as much as 100% of projected structure price or even to a maximum of ninety% of their market value. into the financing demands around Rs. 29 lakh*.

Estimated construction price is usually certified from the a good chartered engineer/designer and you may duly verified because of the Technical Manager. Depending on any is actually prior to the utmost identity in your home financing can either be up to 30 years or do not continue away from retirement age.

0 comentarios