To get property demands a lot of resource, according to the city and also the belongings particular youre willing to buy. Luckily, household guarantee lands are around for finance the acquisition you plan to help you go ahead that have.

Home guarantee is the land value without any money you are obligated to pay to your property useful for to find it. Using a secure equity mortgage, you might change the new security with the dollars as opposed to offering the fresh new residential property.

Although not, it is important to look into the lenders who can supply you with which have funding promptly and you may verify a lower life expectancy rate of interest than simply the others. The analysis process right here will guarantee the thing is that the best land collateral loan right for your requirements.

Knowing the land equity finance

Land guarantee funds are similar to domestic equity fund. not, the home would-be put because security having financial support. The home is intense with no improvements otherwise might have particular structure such as for example liquid contours or stamina.

The individual ready to bring a secure security loan may individual new homes outright or features a land mortgage, a home loan having a bit of house.

A crucial point to see listed here is that property guarantee try sometimes known as lot security, but much may also be used for a bit of belongings that has been increased and that’s happy to begin structure.

Why does a land guarantee mortgage works?

Once you like to score belongings security funds, you are cashing aside some of the security by placing enhance belongings because the equity. If you default on financing, you might remove the floor so you can foreclosure.

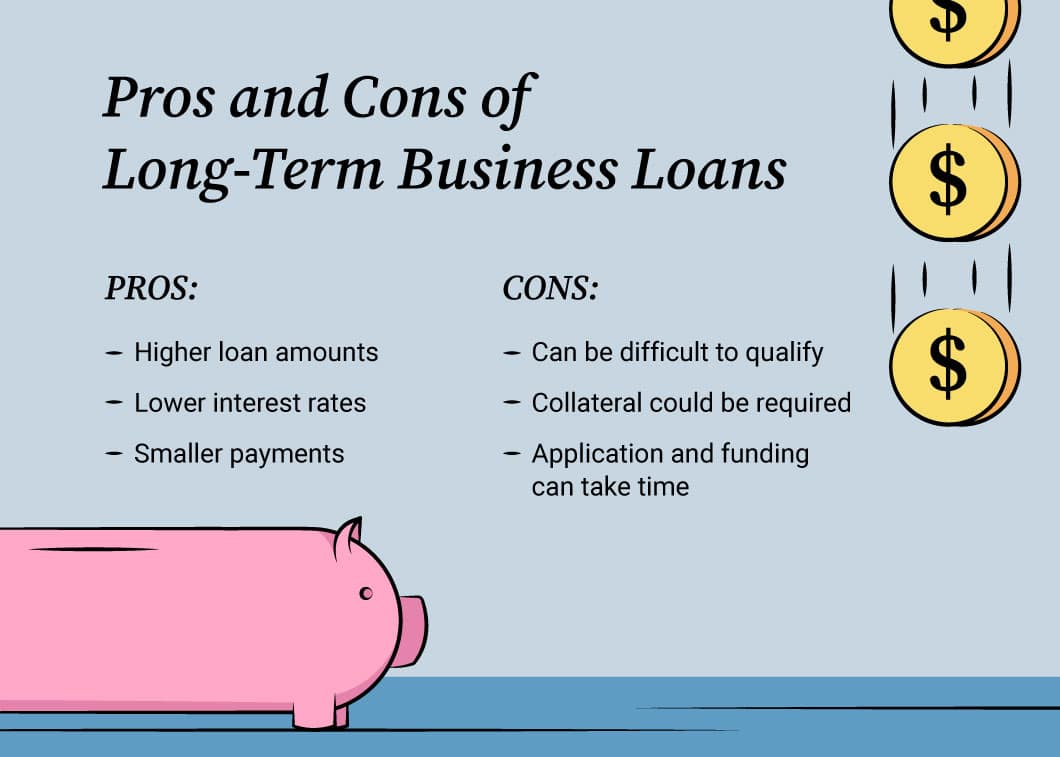

Residential property funds is risky on loan providers, particularly if you are still paying down the home. Thus, what’s needed listed here are a great deal more strict than just about any different kind regarding collateral financing.

Lenders normally desire to come across a lower life expectancy financing-to-worthy of proportion and need warranty out-of less payment conditions. not, considering the exposure the lenders will need, they tend to help you costs higher rates getting residential property guarantee financing.

For those who still have an excellent equilibrium for the loan used for buying this new homes, then collateral mortgage might be a second mortgage right here.

This would mean that if the house goes into property foreclosure, the brand-new financing might possibly be paid back very first, and then the Home equity financing is paid that have any sort of number throughout the profit of the house.

Sorts of belongings collateral money

When the think belongings security fund, you have to know the many readily available designs. Contemplate, for each and every functions in a different way, so lookup and wisdom is essential.

Belongings collateral credit line

Such as HELOC, these types of loan provides access to borrowing as required. This means you merely have to pay the eye for the lent count but not the amount assigned to your.

House collateral dollars-out refinance

Earliest, you ought to pay the initial loan and then the change number. Contemplate, you can lower your repayments right here and you will lock in less interest. Including, you can make use of the additional bucks to evolve your own house and you will clear away the money you owe.

House security design financing

Should you decide to construct a house towards belongings, contemplate specific lenders encourage your own equity as part of this new advance payment into the are produced otherwise construction mortgage loans Zolfo Springs brokers.

However, there’s something you need to keep in mind. There is they much harder to utilize your home security just like the collateral for a loan for many who however owe cash on an effective homes mortgage.

So, when you find yourself still shopping for a land collateral financing bank who can serve you proper, think looking for borrowing unions otherwise regional finance companies in the region. It creates it easy on how to have the resource you need.

0 comentarios