how can i get cash advance

6 Documents Required for the mortgage Pre-Recognition Techniques

If you’re trying to get a mortgage, we wish to make sure you can be eligible for a mortgage to save the process heading because smoothly you could. One particular strategies is always to give records you to definitely guarantee their earnings, assets, and other major loans you may possibly have. This will allow the financier to determine how much so you’re able to accept.

Due to the fact amount of the loan pre-acceptance techniques does take a little while, it’s a good idea to start gathering this new files you’ll need as soon as you decide to buy otherwise refinance a house. This will make it simpler for you and speed up the recognition process.

Home loan Pre-Recognition Record: 6 Documents Requisite

The fresh documents your house financier requires fall under multiple categories. All these data are expected for everybody applicants however, continue planned needed even more data files to possess verification based on your unique state.

step 1. Personality Data files

The fresh financier first needs to guarantee that these include handling you and not people acting to be you. Thus, make an effort to promote a legitimate regulators-approved ID with an image. U.S. people should provide a duplicate of the passport. Non-citizens that have a green Credit should provide a copy from it plus a duplicate of its driver’s license. Non-people who do n’t have an eco-friendly Card should provide a great content of the Performs Charge.

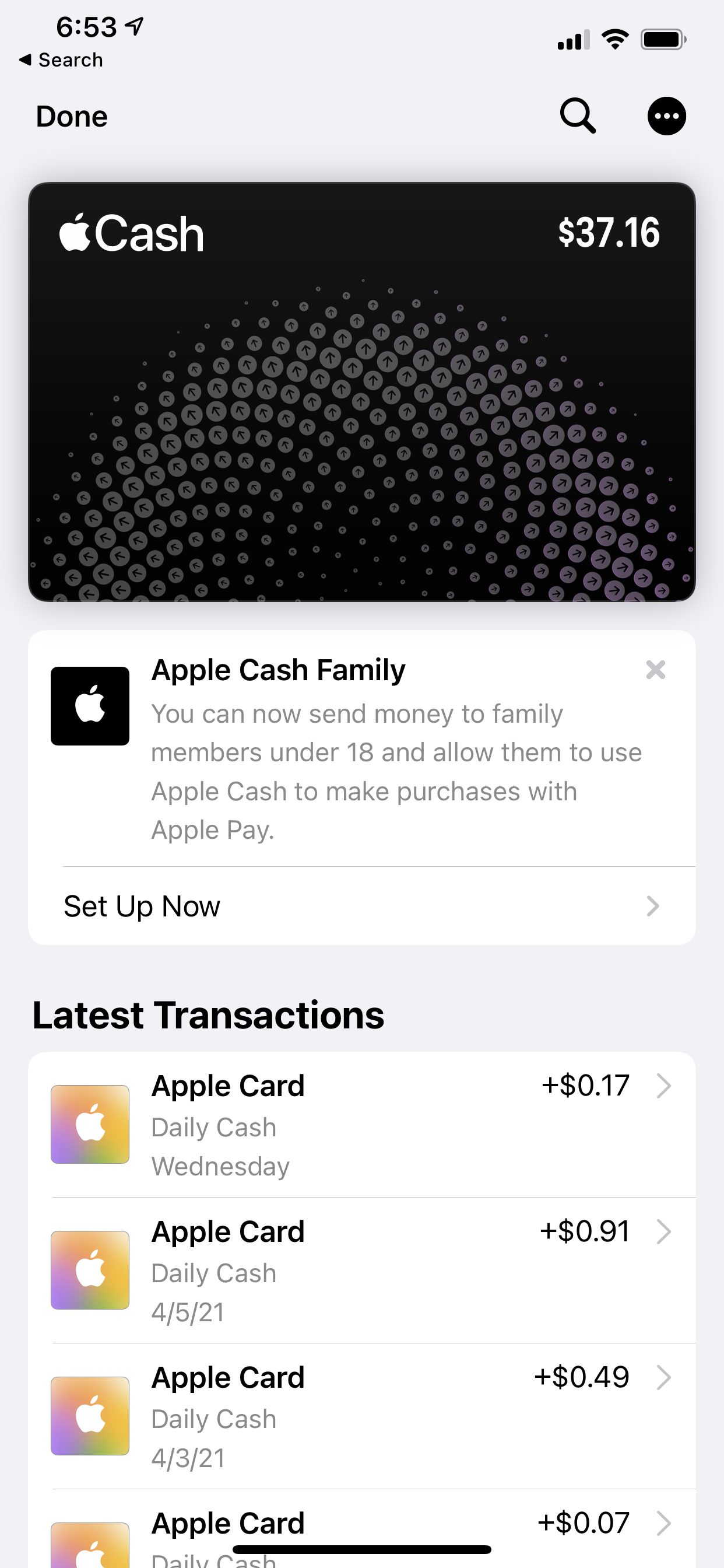

dos. Bank Comments

Your earnings and you will possessions is biggest circumstances during the choosing just how much resource you qualify for. You want the most recent sixty days’ bank statements showing your ready to protection this new advance payment and closure costs. (más…)