six. Accept an offer and you may unlock escrow

After you deal with an offer from your own customer, you can easily over any additional strategies to close such as the household check and household assessment. Thus far, you may want to wonder if you would like be connected and improve your lending company concerning your intentions to offer and you may shell out regarding your remaining financial balance. Yet not, you can rest assured that your 3rd-party escrow organization usually facilitate those individuals communications.

Technically, you don’t need to say anything to the bank when you have approved a deal on the house, verifies Helali. You just keep and also make your payments and as you get closer into the closing day, this new escrow or name organization that is going to become approaching the exchange usually get in touch with the lender and also have a proper incentives report considering an actual closure day. There isn’t far repairs you need to perform.

seven. Comment your payment statement

Among the latest steps away from offering a home could be to review your payment statement, that’s a keen itemized variety of charges and you may loans summarizing the newest money of entire transaction.

- This new profit cost of the property

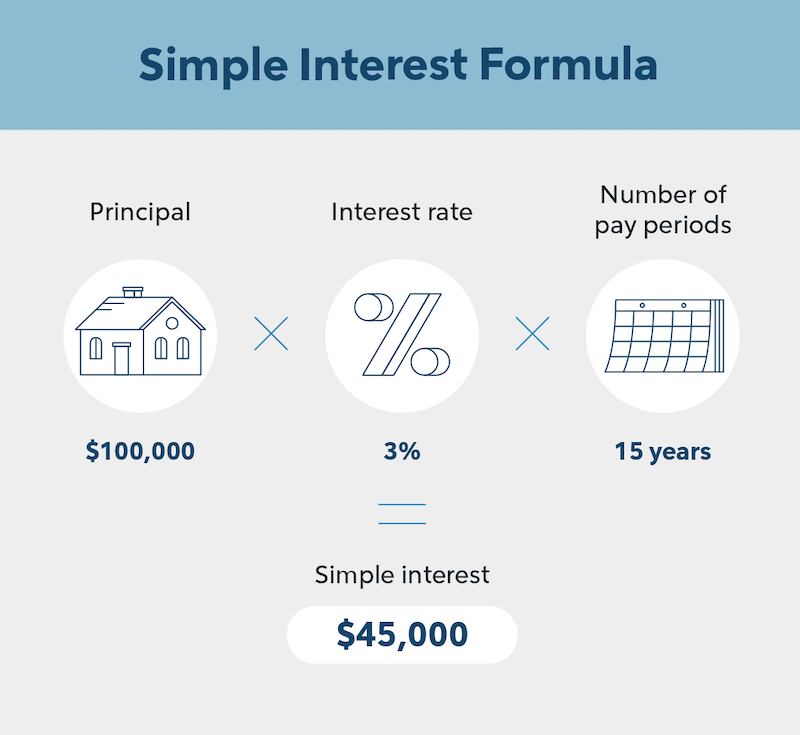

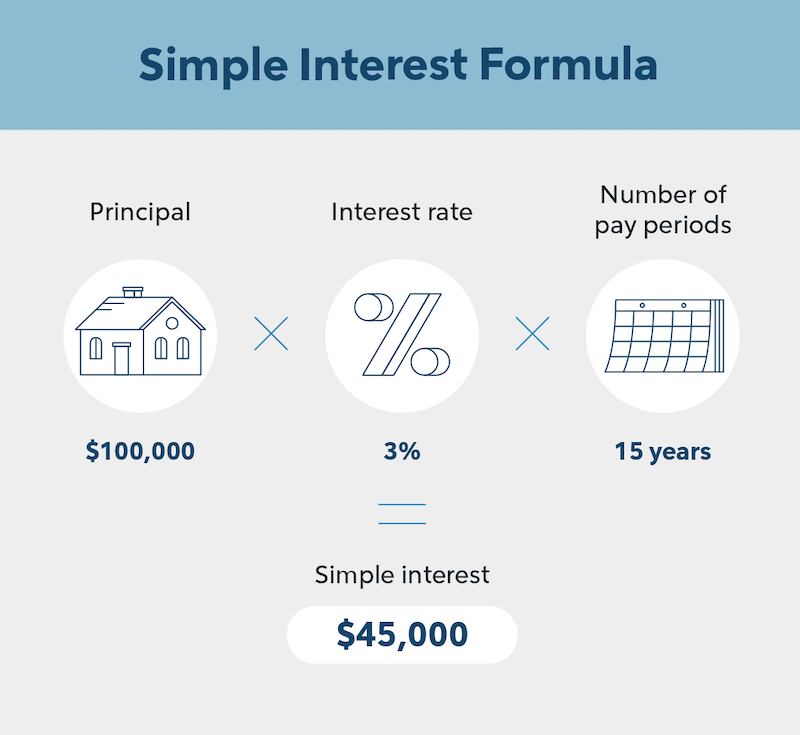

- Your direct home loan benefits amount

- Additional closing costs being deducted about rates

- Who has got bringing paid down, along with agents event fee, regional governments owed taxes and you may recording costs, and finally charges visiting the bank

- Websites proceeds (which will be towards the bottom known as full loans on provider)

You will never yourself have to worry about making sure your bank gets paid back. As Helali teaches you: In the event the customer in your home helps to make the pick, brand new escrow organization gets all the loans and they will develop a straight to your bank. (más…)